What You Will Learn

- What is Multiple Timeframe ?

- Choosing number of Timeframe based on your trading style

- Choosing number of Timeframe based on your personality

- What is TOP DOWN and DOWN TOP analyzation

- Comparing Top-down and Down-top analyzation method

- When we need to use TOP – Down and Bottom up

- Market Cycle theory to connect many timeframe together

- How to anayze 3 time with TOP –Down and Bottom-Up

Requirements

-

Patient to absorb these knowledge

-

This is not “Magic Pills” to be profitable

-

You need back-test from 1 – 3 months

Description

We normally apply this Multiple timeframe theory to trade with Key level strategy and Smart Money Concepts. If you don’t know about this strategy, you can quick refer the info as below

Key level strategy is the combination traditional supply demand and market structure, market cycle theory

Smart Money Concepts is the Combination of Key level strategy and Traditional Supply Demand with Market structure to optimize win rate, reward per risk ration and help trader to control emotion better

You also understand about market structure after this course to know when a trend start, end, continue running. It helps you to have a better win rate, reward per risk ratio to trade even with Inner Circle Trading or ICT method

During learning and practicing, you can leave any your question on QA part of Udemy. Jayce will reply and help you within 12 hours

A trader who want to trade for prop firm company or your own capital, you should learn and master all Key level and Smart Money Concepts. That’s our way to achieve our dream faster

This is mostly suitable for student whole learnt and practiced my strategy, for new traders haven’t yet experienced about trading with price action and market structure, this course will make you complicated while you’re watching

Btw, I also created a Discord channel for students to discuss together. In this channel, we will share the knowledge, tips to learn and analyzation every week on any assets

I also created a Competition that will help learn facing with yourself to improve your psychology, risk management on high pressure environment like real trading. The pressure comes from your competitors’ results, big money capital

All of above activities would help you to come profitable and consistency traders in near future

You can join discord channel to refer about it anytime.

For serious traders only, You also can join NCI learning school to enhance your profitable and consistency level in trading.

That you’re able to manage big funded accounts from top funded companies now

– Level 0 : Multiple timeframe theory, connect from zone to zone

– Level 1 : Complete Key level strategy, drawing key level exactly

– Level 2 : Complete Smart Money Concepts, understanding the real market picture with manipulation

– Level 3 : How to combine Key level and smart money concepts with market cycle theory and Volume

– Level 4 : Using Key level and smart money for day trading, build the road to be success trader, update market structure

– Level 5 : For investing trader, Using Ichimoku to multiple assets and using Golden trend indicator to manage 100 assets

What you can do after this course :

- What is Multiple Timeframe ?

- Choosing number of Timeframe based on your trading styles & personality

- What is TOP DOWN and DOWN Top analyzation

- Which one is better ? Top-down or Down-top?

- When we need to use TOP – Down and Bottom up

- Market Cycle theory to connect many timeframe together

- How to analyze 3 time with TOP –Down and Bottom-Up

To optimize your Reward/Risk | Win Rate | Draw-Down , Price action- Key level or Smart Money Concepts are the best method to choose. But, before you wanna to use those strategies, you should fully understand about cornerstone to apply it effectively

Multiple Timeframe is method to do it, it can help you find out best place to entry with the smallest and safety Stop-Loss by break down structure on low timeframe. Analyze on High Timeframe to select the most strong place to Take Profit.

Additionally, It also helps you trailing stop effectively – let the market run & take profit as far as possible

If you’re SERIOUS TRADER who are ready to be DIFFIRENT this year. Let’s come with us

We will FIGHT TOGETHER for a SUCCESS YEAR

Who this course is for:

- Technical analyzation traders

- New Traders in Forex, Crypto, Stock market

- Non-profitable traders after trading for a long time

- Hard working traders to find best way to be profitable

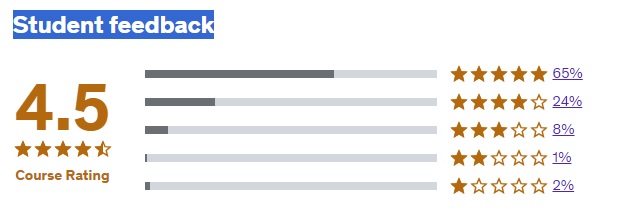

Student feedback